It really is about that 1%

Wow, that top 1% is doing really, really well, you’ll not be surprised to hear. Everyone else, not so well.

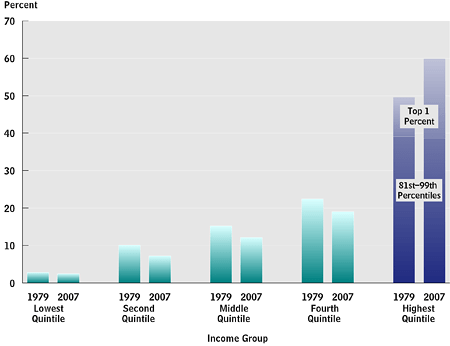

The Congressional Budget Office is out with some new stats on Trends in the Distribution of Income over the last three decades. Between 1979 and 2007, here’s how various slices of the population did in real (inflation-adjusted) income growth after federal taxes:

- top 1%: +275%

- next 19%: +65%

- middle 60%: +40%

- bottom 20%: +18%

Or, in graphic form:

The stairstep pattern—the higher you go up the income ladder, the stronger the growth—is remarkable.

As a result of this vastly unequal growth, the share of after tax income by population slice grew vastly more unequal:

- top 1%: 8% in 1979 to 17% in 2007, more than doubling

- next 19%: 35% in 1979, 36% in 2007, barely changed

- middle 60%: 50% in 1979, 43% in 2007, down 7 points

- poorest 20%: down 2 points, from 7% to 5%

Or, in a picture:

As of 2005, the share going to the top 20% surpassed the share going to the bottom 80%—though as the breakdown shows, most of this shift came from the very top. In 1979, the top 1% claimed about the same share as the bottom 20%; as of 2007, the top 1% hogged as much as the bottom 40%.

It really, really is 99 vs. 1.

Lower limits of income groups, after federal taxes and transfers (table A-1 in the full report):

lowest 20% $ 0 second 20% 18,979 middle 20% 29,759 fourth 20% 42,202 81st percentile 60,557 91st percentile 81,135 96th percentile 109,006 99th percentile 252,607

This is really interesting. I’d like to hear a thoroughgoing economic argument as to why it matters that the bottom and middle income earners have seen only income increases of 18% and 40% over this time period. Because, alas, I can anticipate many arguing that if everyone’s incomes have improved, that’s a trickle-down success and so there is nothing for the 99% to grumble about.

Thanks for this . Go OWS !

Laurence if you look at the second graph you can see that the percentage share of income after saw significant falls in after tax income for 80% while the top 20% almost doubled their share

The reason it matters i because of what the 2nd chart shows. Unequal growth means that The top 1% own a greater proportion of national wealth, and the bottom 40% own a lesser proportion. In a country where wealth is the primary means of exercising power and political influence, this means that the U.s. is becoming more and more undemocratic.

@Laurence Miall

There are various valid questions as to why a person should give two hoots how much the 1% earners actually bring in, are being taxed, etc. The fact is that pre-1979, as the fortunes in the US increased (Gross Domestic Product, productivity, wealth..), the fruits of the prosperity were shared across the *income* spectrum more, and more fairly, than now. There’s a big difference between saying that should be different, and socialism. Key words: income spectrum.

It’s not the same thing as saying if someone makes more than someone else, they should give it away to those less fortunate. That’s an entirely different set of principles and resulting argument. This is about the set of variables affecting overall national financial stability, not having to give up more or less in your paycheck. It’s about overall sustainability and growth.

Pingback: Collective Conscious » ‘It really, really is 99 vs. 1′

I appreciate the responses to my question and it’s helping. Believe me, I really do ask out of genuine curiosity. I feel there is possibly an argument here to be made about the share of wealth that accrues to labor versus capital and that ties into the system’s “sustainability” or lack thereof. But again, I don’t know if an appeal to the notion of “fairness” during the current neo-liberal era totally cuts the mustard when it can be argued that EVERYONE saw income growth. Individualism and the notion of a meritocracy is pretty advanced in America esp. among the right wing.

Marxists would say that the system is inherently prone to crisis and eventually its own demise, right? So what can be derived from these rather shocking graphs that bolster the argument that more wealth should go to labor as opposed to the owners of capital?

I’d love to see the connection between income disparity and the current crisis made a bit clearer. For example, does this tie into issues of the rising debt loads of “average” consumers? Does it impact on property ownership — i.e. the sub-prime mortgage crisis?

I’d also like more clarity around statements such as “pre-1979, as the fortunes in the US increased (Gross Domestic Product, productivity, wealth..), the fruits of the prosperity were shared across the *income spectrum.”

Sure, but what is the relationship between productivity and income distribution “fairness”? Was the US more productive BECAUSE lower income earners were better off relative to the higher income earners? Or is it just that the pie was divided up a little more fairly because …. because people believed more in fairness back then?

I don’t really think it could be the latter. The sharp post-war growth in America’s GDP permitted and even required more equitable income distribution. The job market was different. Manufacturing jobs were plentiful and often well paid. There’s the famous rise of the middle class and all that stuff Michael Moore laments the passing of in “Capitalism: Not a Love Story.”

Oh, and I really like your note, John Miller. It really does appear to pervert democracy that the rich have, not just wealth, but social power.

Laurence: there is the interesting paper ‘Inequality, Leverage and Crises’ by Michael Kumhof and Romain Rancière available at http://www.imf.org/external/pubs/ft/wp/2010/wp10268.pdf

From the abstract: “The paper studies how high leverage and crises can arise as a result of changes in the income distribution. Empirically, the periods 1920-1929 and 1983-2008 both exhibited a large increase in the income share of the rich, a large increase in leverage for the remainder, and an eventual financial and real crisis. The paper presents a theoretical model where these features arise endogenously as a result of a shift in bargaining powers over incomes. A financial crisis can reduce leverage if it is very large and not accompanied by a real contraction. But restoration of the lower income group’s bargaining power is more effective.”

@Laurence Miall Thanks. Good questions. Its always good to ask questions and flesh out what we mean (within reason of course, time permitting etc. etc.) I often have the same questions.

I think your second figure is for before-tax income (Summary Figure 2 in the report) rather than after-tax (Summary Figure 3).

The super-rich should be concerned about these numbers, purely out of self-interest.

There has always been and, I fear, always will be income inequality.

However, there is a breaking point (I don’t know exactly where it is) where a society, especially a formally democratic society like ours, simply cannot stand the strain of such MASSIVE disparities in outcomes [sic].

Wonder if you’d care to rebut any of this, which I saw last night:

http://www.pbs.org/newshour/bb/business/july-dec11/makingsense_10-26.html

I wonder what historical precedents there are for this skewed income growth.

Why it matters: the U.S. is a rentier state and the “rents” serve to stifle productive activity. Why is there so much underemployment and unemployment among able-bodied people? Is it really economically productive to shut down factories in country A and move them to country B? We have a set of economic rules that lead to enormous waste.

I don’t think these skewed incomes are responsible for our current crisis, however, except in the sense this wealth has allowed the financial sector to capture the government. The economic crisis is a consequence of deregulation and the elimination of prosecution of white collar crime after 9/11.

I wonder what historical precedents there are for this skewed income growth.

The last time there was a similar income growth was just before the Great Depression

I don’t think these skewed incomes are responsible for our current crisis

They’re a big contributing factor actually. The rich are less likely to spend their money, and more likely to ‘invest’ it in non-productive speculative activities, or invest it abroad. The current problems are in part due to their simply being insufficient demand because, you guessed it, the rich grabbed all the money.

The other big contributor to the crisis is debt. One of the big reasons for a rise in debt is that people’s incomes haven’t been keeping pace with the cost of living.

So fix income disparity, and you’d fix a lot of the structural problems that got us into this mess.

Argh, not income growth . I meant income gaps.

Cian,

I agree with you; the economy would be doing much better if it had a more egalitarian structure. Nevertheless, I think the current crisis is directly the result of a crime wave that was made possible by deregulation and regulatory capture; If all this fraud and speculation had not taken place the economy would be very different. The austerity “fixes” have also been making a bad situation worse. At the end of the day all of this comes down to quantifying how large the different effects are and I don’t have that information.

Pingback: Global Crisis & the New North American Poverty « The Paltry Sapien

Pingback: A Tale of Two Podcasts on the 1%: Do Andrew Kliman and Russ Roberts agree? « The Loyal Opposition to Modernity:

Where will incomes be in five or ten years time if the only source of wealth is rampant speculation? Perhaps there is a relationship between increasingly disparates shares of income and deindustrialization, and between deindustrialization and globalization and between globalization and disenfranchisement and between disenfranchisement and financialization and between financialization and increasingly disparate shares of income. In other words the trickle down effect simply represents the increasing degradation of democracy insofar as such paltry improvements could not have taken place had the people been politically capable of defending their share of income.